Ever felt the sting of exchange rates? Alternatively hoped you could easily manage many currencies. A multi-currency wallet therefore comes in handy. It transcends a digital piggy bank. It is a financial toolset, of storing, transmitting, and accepting many currencies all in one location. Consider the ease for enterprises, travellers, or anybody handling worldwide funds.

This blog goes beyond technology, about how this instrument could help to simplify your financial life. From features to expenses, we will explore the nuts and bolts—that is, how to develop your own multi-currency wallet. Let’s begin.

What is a Multi-Currency Wallet?

What then is all the hype over multi-currency wallets?

Consider it as a digital vault for multiple currencies. This is a physical tool or a software program allowing you to handle and save several currencies. You could carry yen, dollars, euros, or even cryptocurrency. It’s like carrying around a worldwide bank account.

These wallets streamline international trade. There are no longer problems with money exchange. They address payments, conversions, and transfers. For anyone handling foreign money, it’s a useful tool. Companies pay their suppliers with these. Travellers use them to save on heavy exchange costs. All told, it’s a contemporary answer for a world going global.

How Does a Multi-Currency Wallet Work?

Imagine yourself wanting to transfer euros but only carrying dollars. One can manage the transition using a multi-currency wallet. It ties along with feeds on currency rates, making a transaction immediately in any currency. It serves as your fund’s clever translator.

The wallet speaks with banks and payment networks via APIs, and offers services like checking balances, confirming your identification, and running transactions.

Certain wallets even support cryptocurrencies. They interact via blockchain systems. Since these wallets deal in the financial segment, security is the most important aspect. They protect your money using encryption and other techniques. It combines security, financial, and software aspects, all cooperating to simplify commerce.

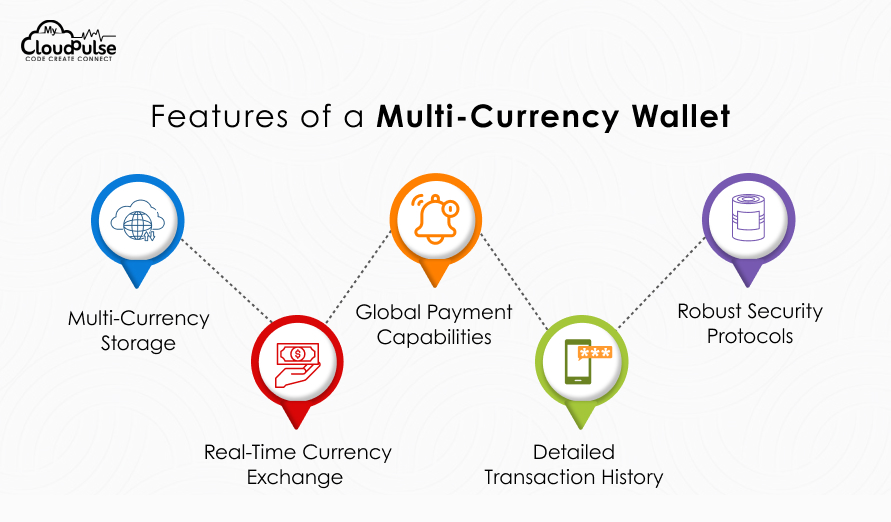

What qualifies a decent multi-currency wallet? Certainly, the features it carries. Keeping this in mind, here are some of the essential features of a multi-currency wallet:

Features of a Multi-Currency Wallet

1. Multi-Currency Storage:

Multiple-currency storage is the process of storing many fiat and cryptocurrencies at one digital location. Sort many assets without balancing several accounts. Designed for a global economy, it functions as a digital safe.

2. Real-Time Currency Exchange:

Get currency rates in real time. Instant conversion of currencies helps to minimise the influence of market changes. Timeliness in transactions and financial planning depend on this ability.

3. Global Payment Capabilities:

Send and get money across borders with simplicity. Pay friends, relatives, or vendors wherever to avoid conventional banking restrictions. It’s about flawless worldwide financial exchanges.

4. Detailed Transaction History:

Track every inflow and outflow with a detailed, searchable history. Control expenditure, examine financial trends, and streamline accounting. Your hands are financially transparent.

5. Robust Security Protocols:

Advanced encryption, two-factor authentication, and fraud detection will help to protect assets. First of all, security guarantees consumer confidence and protects priceless money from dangers.

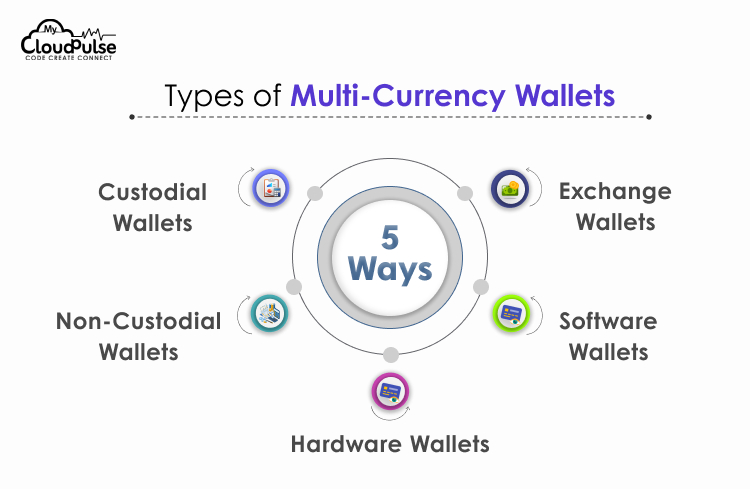

Types of Multi-Currency Wallets

Based upon the mode of operations, there are several types of multi-currency wallets. Let’s discuss each of them in details:

1. Custodial Wallets:

Custodial Wallet manages your private keys with the service providers. Consider it your digital bank account. Simple to use, but your reliance on the security of the supplier. Perfect for novices who choose ease over complete control.

2. Non-Custodial Wallets:

You have your private keys, therefore giving you total control over your money. Users who give security and autonomy a priority will find this a better alternative. It calls on a better knowledge of security best practices and key management.

3. Hardware Wallets:

Hardware wallets are actual gadgets meant to keep your private keys off-site. Keeping money away from online risks helps them to provide the best degree of security. Perfect for consumers who value long-term security or who own large quantities of bitcoin.

4. Software Wallets:

Software wallets are the apps on your computer or phone that save your private keys. They strike a mix between security and ease. To reduce risks, choose reliable vendors and develop good security practices.

5. Exchange Wallets:

These are the wallets connected with bitcoin exchanges mostly used on the trade platform for fund keeping and trading. Easy for active traders; yet, users have to rely on the security and stability of the exchange.

Benefits of Building a Multi-Currency Wallet for Businesses

Why should a company create a multi-currency wallet? The simple answer is, it creates worldwide marketplaces. At the same time, it’s a great business idea to have. Here are some of the reasons why you should consider spending in multi-currency wallet development:

a. Expanded Global Reach:

Help smooth out dealings with suppliers and foreign customers. Eliminate money restrictions and open fresh markets. This enables the global economy’s diversification and company expansion.

b. Reduced Transaction Costs:

Minimised transaction costs by use of foreign transfers and currency exchange charges. Simplify financial practices and raise profit margins. For companies managing cross-border payments, this may result in significant savings.

c. Enhanced Customer Experience:

Provide consumers the ease of paying in their native currency. Offering numerous payment choices helps to increase loyalty and satisfaction. This raises customer engagement and suits a larger audience.

d. Simplified Financial Management:

Combine many currency accounts into one easily navigable platform. Simplify financial flow visibility and accounting procedures to improve your perspective. This lowers administrative expenses and boosts efficiency.

e. Increased Operational Efficiency:

Reduced time spent on hand currency changes and cross-border payments will help to improve operational efficiency. Simplify financial procedures and release resources for main operations of the company. This increases output and best distributes resources.

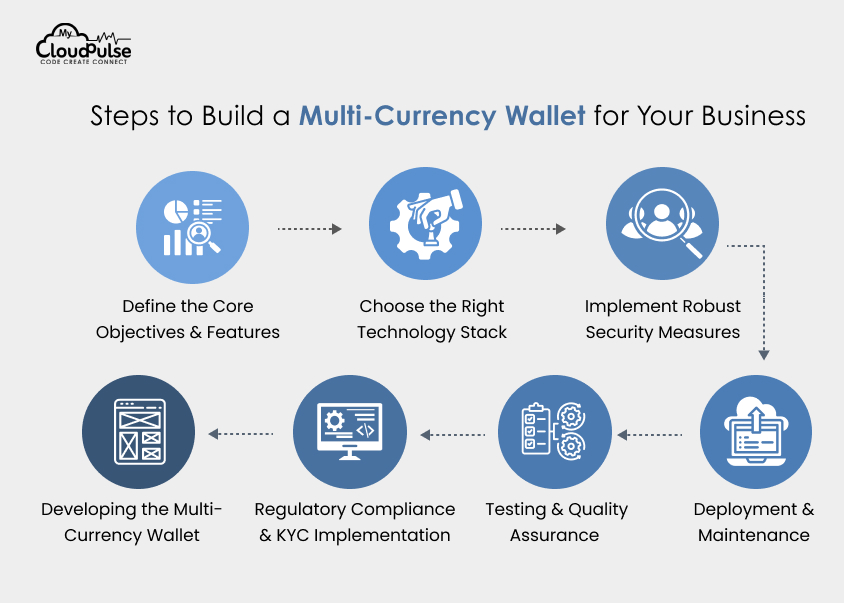

Steps to Build a Multi-Currency Wallet for Your Business

Thinking of creating a multi-currency wallet? The success of the same would depend upon a streamlined development process. Here is the step-by-step process of developing a multi-currency wallet:

Step 1: Define the Core Objectives & Features

What purpose should your wallet serve? Who will be its users? Which currencies should it deal with? What qualities are they seeking? Create a list of all the objectives and select the top priority. Turn your attention to what counts, and stay out of the weeds.

Step 2: Choose the Right Technology Stack

Technology stack plays a crucial role in the performance and success of the multi-currency wallet. What programming languages are to be used? Under what databases? What APIs? Take scalability into account. Consider the long run. Choose nothing that would restrict you. Right technology stack helps to simplify development.

Step 3: Implement Robust Security Measures

The first and foremost important priority is security. Employ encryption and add two-factor authentication. Safeguard consumer information. See through things like a hacker. Point out the areas of weakness and correct them. Security is not something to consider second nature.

Step 4: Developing the Multi-Currency Wallet

Get right to coding. Construct the basic elements and the user interface. Make it understandable for the users. Test as you run, do not wait till the very last. Get comments and feedback as you go.

Step 5: Regulatory Compliance & KYC Implementation

Play by the guidelines. Stop financial lashing-through. Respect the local laws and hire a legal advisor. Neglect this stage at no risk. Later on, it could help you avoid headaches.

Step 6: Testing & Quality Assurance

Investigate everything. User research, testing performance, security evaluation, everything plays a very crucial role. Search for flaws and correct them. Check to see if the app works perfectly fine in different environments. Releasing a flawed product damages your standing.

Step 7: Deployment & Maintenance

Once the application is fully developed and tested, launch the wallet and track its success. Get feedback from real users and make the necessary changes as you go. Maintenance is as important as developing your wallet – take it very seriously.

Cost to Develop a Multi Currency Wallet?

The cost of multi-currency wallet development depends upon several factors. Let’s discuss each of them in details:

1. Location of the Development Team

Costs of development vary depending on the location of your development team. Europe and America are expensive as compared to countries like India and Ukraine. While European and American developers charge around $150 per hour, you may get the same quality services for $25-$40 from Indian developers.

2. Number of Chains and Currencies

How many currencies does your multi-currency wallet support also impact the cost of development. Also, if you plan to integrate blockchain into your wallet, the complexity increases and so does the cost. If you are short on budget, it’s always better to go with a simple wallet with limited currencies initially, and then you may keep adding more currencies.

3. Implemented Security Measures

Security pays for itself. Compliance, audits, and encryption all come out to sum. Still, it is well worth it. One does not have choices in security. That is a need. One cannot trust a dangerous wallet.

4. Expertise of the Development Team

Experiences count. Seasoned developers are more expensive. They perform the work, however, correctly. They are aware of the risks. They stay away from expensive errors. Never employ amateurs. This is not a beginning project.

5. Number of Resources Deployed

The number of developers deployed on the project also impacts the cost. Having a larger team may cost you more but the work is done quickly. Therefore, it is important to know your priority and hire the programmers accordingly.

6. Third-Party Integrations & Tech

Payments gateways, blockchain nodes, third-party integrations and tech APIs, each adds to the cost. Still, they improve value. They simplify the usage of your wallet. Make a sensible choice. Don’t go overboard. Only get what you really need.

Conclusion

Developing a multi-currency wallet is a great business idea if done properly. As the market is going digital, more and more people are using mobile phones to send and receive money. However, not all wallets support multiple currencies which makes this investment a worthy choice.

If you are planning to develop a multi-currency wallet, we have listed everything in this blog worth keeping in mind. Hire the right development partner, choose your features wisely, and you can certainly build a million-dollar business around it.

At MyCloudPulse Technology Private Limited, we understand that a multi-currency wallet requires more than simply programming. Get in touch with us today to discuss your app idea, and start building something amazing.

Frequently Asked Questions (FAQs)

Answer: Complexity influences development time. While a feature-rich platform with crypto integration may span a year or more, a simple wallet could just take a few months. All of this counts: planning, development, testing, and compliance.

Answer: Priority one is security. Install frequent security audits, two-factor authentication, and strong encryption. Also very vital is following KYC/AML rules. Give safe coding standards first priority and guard user information at any means.

Answer: You definitely can. Combining crypto provides a greater spectrum of services but increases complexity. Blockchain connections, private key management, and safe crypto transactions will all fall within your purview.

Answer: Server maintenance, security upgrades, bug repairs, and customer service include maintenance expenditures. Anticipate continuous costs for platform scalability, performance monitoring, and addressing compliance changes.

Answer: Local regulations differ. Common needs include data privacy rules, KYC/AML compliance, and financial service rules. See attorneys to be sure your wallet satisfies all the criteria.