In the ever-evolving landscape of digital finance, a groundbreaking initiative is poised to redefine the way we perceive and manage asset ownership. Finternet, spearheaded by Infosys Chairman Nandan Nilekani, is an ambitious project aimed at creating a unified, interoperable digital infrastructure for financial services. Set to go live in 2026, Finternet promises to democratize access to assets, enhance liquidity, and foster global economic inclusion.

Understanding Finternet: A New Paradigm in Financial Infrastructure

At its core, Finternet is an open, programmable infrastructure designed to represent, exchange, and govern value in a secure and verifiable manner. Unlike traditional financial systems that are often fragmented and siloed, Finternet seeks to interconnect diverse financial ecosystems, enabling seamless transactions across borders and jurisdictions. By leveraging technologies such as tokenization, artificial intelligence (AI), and regulatory compliance, Finternet aims to create a transparent and efficient financial ecosystem.

The Role of Tokenization in Asset Ownership

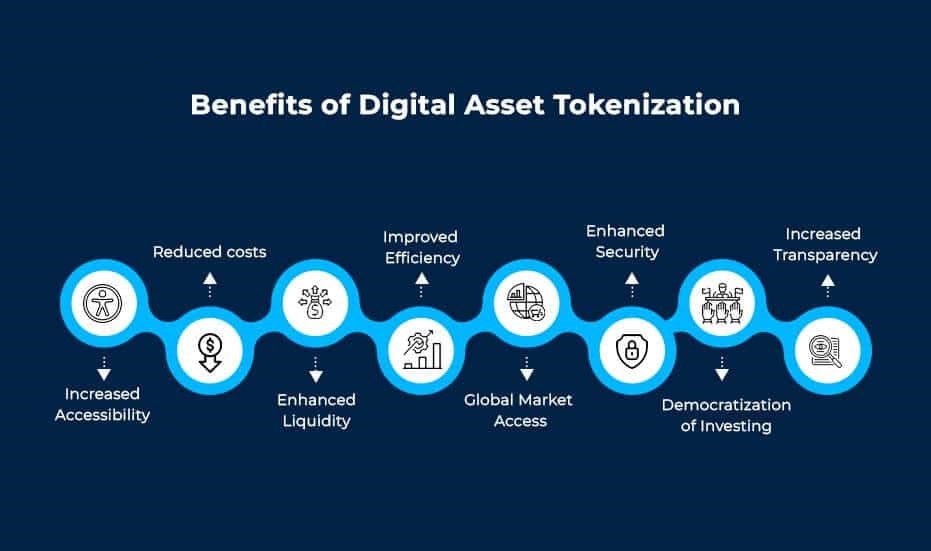

A central feature of Finternet is the tokenization of real-world assets, including land, real estate, gold, and bonds. Tokenization involves converting physical assets into digital tokens that can be securely traded and transferred on a blockchain. This process unlocks previously inaccessible value, allowing for fractional ownership and broadening investment opportunities to a global audience. For instance, individuals can invest in a portion of a commercial property or a fraction of gold holdings, thereby lowering the barriers to entry for asset ownership.

Artificial Intelligence: Enhancing Efficiency and Compliance

Finternet integrates AI to automate and optimize various aspects of financial transactions. AI algorithms can assess creditworthiness, detect fraud, and ensure compliance with regulatory standards in real-time. By embedding AI into the financial infrastructure, Finternet not only enhances operational efficiency but also builds trust among participants by ensuring that transactions adhere to established legal and ethical norms.

Global Expansion and Strategic Partnerships

Since its inception in 2023, Finternet has rapidly expanded its reach. As of 2025, the initiative encompasses 10 cohorts across eight sectors and has established partnerships with 30 ecosystem players worldwide. The platform is operational in countries such as India, Singapore, the United States, and Switzerland. Looking ahead, Finternet plans to go live with real-world use cases in 2026, marking a significant milestone in its journey to revolutionize global financial infrastructure.

Benefits of Finternet for Asset Owners

1. Democratization of Asset Ownership

By enabling fractional ownership through tokenization, Finternet allows individuals from diverse economic backgrounds to invest in high-value assets. This democratization fosters financial inclusion and empowers a broader segment of the population to participate in wealth creation.

2. Enhanced Liquidity

Tokenized assets can be traded on digital platforms, providing liquidity to traditionally illiquid markets. This increased liquidity facilitates quicker and more efficient transactions, benefiting both asset holders and investors.

3. Global Access

Finternet’s interoperable infrastructure enables users from different parts of the world to access and invest in a wide range of assets. This global reach opens up new avenues for cross-border investments and economic collaboration.

Challenges and Considerations

While the prospects of Finternet are promising, several challenges must be addressed:

• Regulatory Alignment: Ensuring that tokenized assets comply with existing financial regulations across various jurisdictions is crucial for the widespread adoption of Finternet.

• Technological Integration: Integrating Finternet with legacy financial systems requires significant technological advancements and collaboration among stakeholders.

• Security Concerns: Protecting digital assets from cyber threats necessitates robust cybersecurity measures and continuous monitoring.

How MyCloudPulse Can Contribute?

As an app development firm specializing in fintech solutions, we are uniquely positioned to support the implementation and growth of Finternet. Our expertise encompasses:

• Blockchain Integration: Developing secure and scalable blockchain applications for asset tokenization and smart contract execution.

• AI-Powered Solutions: Implementing AI algorithms for credit scoring, fraud detection, and compliance monitoring within financial applications.

• Cross-Platform Development: Creating user-friendly mobile and web applications that facilitate seamless interaction with the Finternet ecosystem.

• Regulatory Compliance Tools: Building tools that ensure adherence to financial regulations and standards in various jurisdictions.

By collaborating with us, stakeholders in the Finternet ecosystem can leverage our technological capabilities to build secure, efficient, and compliant financial applications that align with the vision of a unified global financial infrastructure.

Conclusion

Finternet represents a paradigm shift in the way assets are owned, managed, and transacted globally. Through the integration of tokenization, AI, and regulatory compliance, it promises to create a more inclusive, efficient, and transparent financial system. As we approach the 2026 launch, the opportunity to participate in this transformative initiative is within reach. By embracing the Finternet, individuals and institutions alike can be part of a global movement towards a more equitable and interconnected financial future.