The landscape of fundraising is undergoing a seismic shift. Enter the Equity Token Offering (ETO), a revolutionary approach that leverages blockchain technology to democratize access to capital and empower businesses. This guide delves into the intricacies of launching a successful ETO, from understanding its core principles to navigating the complexities of development and launch.

What is an Equity Token Offering?

At its essence, an ETO represents a novel form of fundraising where businesses issue digital tokens that represent ownership stakes in the company. These tokens, akin to shares of stock, are issued on a blockchain, providing transparency and immutability to the ownership records.

Unlike traditional equity fundraising, ETOs offer several key advantages:

- Enhanced Accessibility: ETOs can attract a global pool of investors, transcending geographical limitations and broadening the investor base.

- Increased Liquidity: In theory, ETOs can offer greater liquidity than traditional private equity investments, as tokens can be traded on decentralized exchanges.

- Improved Transparency: Blockchain technology ensures complete transparency and immutability of ownership records, enhancing trust and accountability.

- Streamlined Operations: Smart contracts automate many aspects of the ETO process, such as dividend distribution and shareholder voting, reducing administrative overhead.

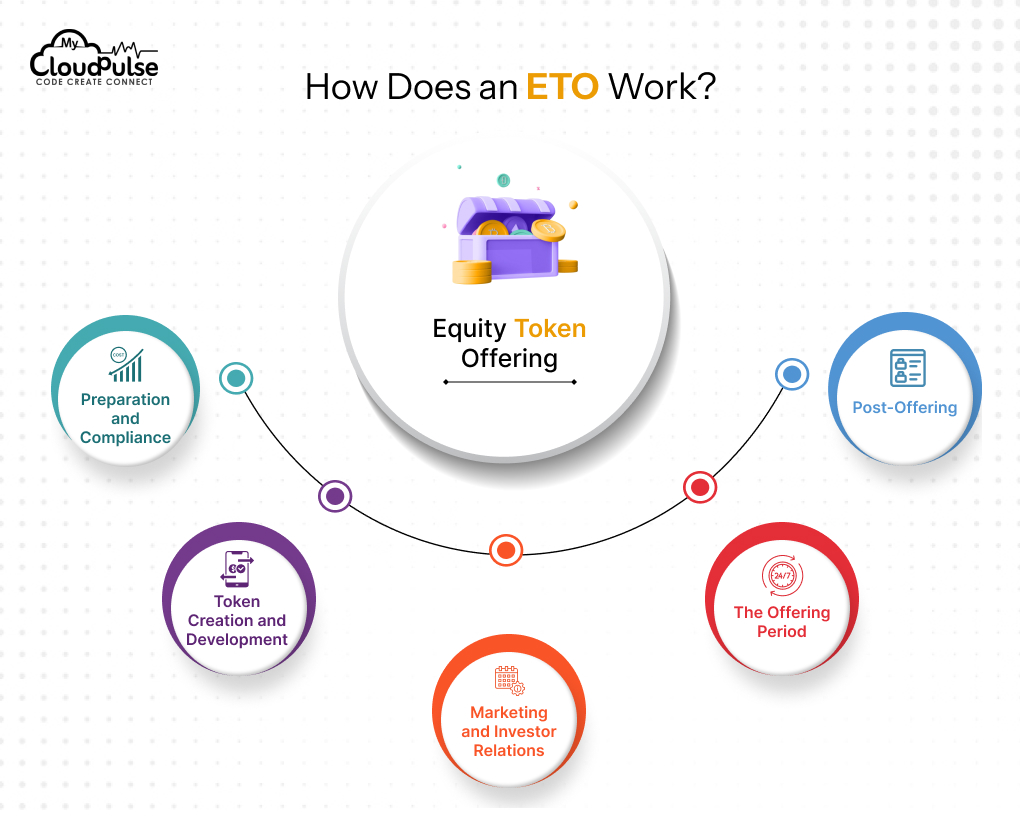

How Does an Equity Token Offering Work?

The ETO lifecycle can be broadly categorized into the following key stages:

1. Preparation and Compliance:

- Legal and Regulatory Framework: Thoroughly research and adhere to all applicable securities laws and regulations in the jurisdictions where the ETO will be conducted.

- Tokenomics and Whitepaper: Define the token’s purpose, utility, distribution model, and economic parameters. Create a comprehensive whitepaper outlining the project’s vision, team, roadmap, and risk factors.

- Financial Projections: Develop robust financial models to project the company’s future growth and demonstrate the viability of the ETO.

2. Token Creation and Development

- Blockchain Platform Selection: Choose a suitable blockchain platform (e.g., Ethereum, Binance Smart Chain) based on factors like scalability, security, and transaction costs.

- Smart Contract Development: Develop and rigorously test smart contracts to govern token issuance, distribution, and management, ensuring security and functionality.

- Token Standards: Adhere to relevant token standards (e.g., ERC-20, ERC-1400) to ensure interoperability and compatibility with existing blockchain ecosystems.

3. Marketing and Investor Relations

- Build a Strong Brand: Develop a compelling brand story and effectively communicate the project’s value proposition to potential investors.

- Investor Outreach: Conduct targeted marketing campaigns, including social media outreach, content marketing, and potentially, paid advertising to attract qualified investors.

- Community Building: Foster a strong community around the project by engaging with potential investors through online forums, social media channels, and potentially, offline events.

4. The Offering Period

- Launch the ETO: Launch the token sale on a suitable platform, which could be a dedicated ETO platform, a decentralized exchange, or a combination of both.

- Investor Onboarding: Implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to comply with regulatory requirements and ensure investor due diligence.

- Manage Investor Funds: Securely manage investor funds and ensure timely and transparent distribution of tokens.

5. Post-Offering

- Token Distribution: Distribute tokens to investors according to the agreed-upon terms.

- Ongoing Governance: Establish mechanisms for ongoing governance and decision-making, such as shareholder voting and community forums.

- Liquidity Provision: Explore options for providing liquidity to the token, such as listing on decentralized exchanges or creating market-making programs.

- Investor Relations: Maintain ongoing communication with investors, regularly updating project progress and addressing any concerns.

Key Features of a Successful Equity Token Offering(ETO)

a. Transparency and Accountability

Blockchain technology ensures complete transparency of all transactions and ownership records.

b. Enhanced Security

Smart contracts provide high security and reduce the risk of fraud or manipulation.

c. Global Reach

ETOs can attract investors from around the world, expanding the potential investor pool.

d. Increased Efficiency

Automation through smart contracts streamlines many aspects of the ETO process, reducing administrative overhead.

e. Investor Empowerment

ETOs can empower investors with greater control and influence through mechanisms such as token voting and direct participation in company governance.

Steps to Launch Your ETO

1. Define Your Objectives

Clearly define your fundraising goals, target investor base, and the specific use of funds raised through the ETO.

2. Conduct Thorough Due Diligence

Research applicable securities laws and regulations, and engage with legal and financial advisors to ensure compliance.

3. Develop a Robust Business Plan

Create a comprehensive business plan that outlines the project’s vision, team, roadmap, and financial projections.

4. Choose the Right Blockchain Platform

Select a blockchain platform that best suits your project’s specific needs and requirements.

5. Build a Strong Development Team

Assemble a skilled team of developers, legal advisors, and marketing professionals with expertise in blockchain technology and securities law.

6. Develop a Compelling Marketing Strategy

Craft a compelling marketing narrative to attract investors and build a strong community around your project.

7. Launch the ETO

Conduct a well-planned and executed token sale, ensuring a smooth and efficient process for both the company and investors.

8. Maintain Ongoing Investor Relations

Foster strong relationships with investors through regular communication, updates, and community engagement.

Types of Equity Token Offering (ETO)

a. Security Token Offerings (STOs)

STOs are a specific type of ETO that comply with securities regulations, offering investors rights and protections similar to traditional equity investments.

b. Initial Coin Offerings (ICOs)

While technically distinct from ETOs, ICOs share some similarities in terms of fundraising through the issuance of digital tokens.

c. Regulation A+ Offerings

These offerings leverage a U.S. Securities and Exchange Commission framework for raising capital, combining elements of traditional and tokenized fundraising.

d. Decentralized Autonomous Organizations (DAOs)

DAOs utilize tokens to govern and fund decentralized organizations, enabling community-driven decision-making and resource allocation.

e. Hybrid Models

Hybrid models combine elements of different fundraising approaches, such as STOs and ICOs, to create unique and innovative offerings.

Tools and Technologies

- Blockchain Platforms: Ethereum, Binance Smart Chain, Polygon, Solana

- Token Creation Platforms: Polymath, TokenMint, Securitize

- Investor Management Platforms: SeedInvest, EquityZen

- Smart Contract Development Tools: Truffle Suite, Hardhat, Remix

- Wallet Providers: MetaMask, Coinbase Wallet, Trust Wallet

Challenges in Launching an ETO

a. Regulatory Uncertainty

The regulatory landscape surrounding ETOs is constantly evolving, creating challenges for companies and investors.

b. Market Volatility

The cryptocurrency market is highly volatile, which can significantly impact the success of an ETO.

c. Competition

The ETO market is becoming increasingly competitive, making it crucial to differentiate your project and attract investor attention.

d. Liquidity Concerns

Ensuring sufficient liquidity for ETO tokens can be challenging, which can impact their trading price and investor returns.

e. Investor Education:

Educating investors about the intricacies of ETOs and their associated risks is crucial for building trust and ensuring long-term success.

Cost of Launching an ETO

The cost of launching an ETO can vary significantly depending on several factors, including:

- Complexity of the project

- Blockchain platform chosen

- Legal and regulatory requirements

- Marketing and investor relations efforts

- Development team costs

Generally, the costs can range from tens of thousands to hundreds of thousands of dollars.

Why Choose CloudPulse?

CloudPulse is a leading provider of blockchain development services, with a proven track record of success in delivering innovative and high-quality solutions. Our team of experienced developers, legal advisors, and marketing professionals can guide you through every stage of the ETO launch process, from concept to completion.

Contact CloudPulse today to discuss your ETO project and learn how we can help you achieve your fundraising goals.

Disclaimer: This guide is for informational purposes only and should not be construed as financial or legal advice.

FAQs

Enhanced accessibility to capital: ETOs can attract a global pool of investors, transcending geographical limitations.

Increased liquidity: ETOs can potentially offer greater liquidity compared to traditional private equity investments.

Improved transparency: Blockchain technology ensures complete transparency and immutability of ownership records.

Streamlined operations: Smart contracts automate many aspects of the ETO process, reducing administrative overhead.

Preparation and Compliance: Research and adhere to all applicable securities laws and regulations.

Token Creation and Development: Develop and test smart contracts on a suitable blockchain platform.

Marketing and Investor Relations: Conduct marketing campaigns and build a strong community around the project.

The Offering Period: Launch the token sale and manage investor funds.

Post-Offering: Distribute tokens to investors and maintain ongoing investor relations.

Regulatory uncertainty: The regulatory landscape surrounding ETOs is constantly evolving, creating challenges for companies and investors.

Navigating varying regulations across different jurisdictions can be complex and

time-consuming.

Staying updated on the latest regulatory developments is crucial to ensure

compliance and avoid potential legal issues.

Market volatility: The cryptocurrency market is highly volatile, which can significantly impact the success of an ETO.

Price fluctuations can affect investor sentiment and potentially impact the success of

the fundraising round.

Managing price volatility requires careful planning and risk mitigation strategies.

Competition: The ETO market is becoming increasingly competitive, making it crucial to differentiate your project and attract investor attention.

Standing out from the crowd requires a strong value proposition, a compelling

narrative, and effective marketing strategies.

Building a strong brand and community is essential for attracting and retaining

investor interest.

Liquidity concerns: Ensuring sufficient liquidity for ETO tokens can be challenging, which can impact their trading price and investor returns.

Limited trading volume can make it difficult for investors to buy or sell their tokens

easily.

Liquidity provision mechanisms, such as market-making programs or listing on

reputable exchanges are crucial for ensuring long-term success.

Investor education: Educating investors about the intricacies of ETOs and their associated risks is crucial for building trust and ensuring long-term success.

Clear and transparent communication is essential to inform investors about the project’s

risks and rewards.

Building investor confidence requires a strong emphasis on transparency, accountability,

and responsible project management.

The cost of launching an ETO can vary significantly depending on several factors, including:

Complexity of the project: More complex projects with intricate tokenomics and sophisticated smart contracts will generally incur higher development costs.

Blockchain platform chosen: Different blockchain platforms have varying costs associated with development and transaction fees.

Legal and regulatory requirements: Navigating complex legal and regulatory frameworks can involve significant legal fees.

Marketing and investor relations efforts: Extensive marketing campaigns and investor outreach programs can also add to the overall costs.

Development team costs: The cost of hiring a skilled development team, including blockchain developers, smart contract auditors, and legal advisors, can vary significantly.

Generally, the costs can range from tens of thousands to hundreds of thousands of dollars, and in some cases, even millions of dollars for large-scale projects.

Scalability: The platform should be able to handle a high volume of transactions and support a large number of users.

Security: The platform should have robust security measures to protect against hacks and other cyber threats.

Decentralization: A high degree of decentralization ensures the platform’s resilience and resistance to censorship.

Transaction speed and costs: Low transaction fees and fast transaction speeds are crucial for a smooth user experience.

Developer community and ecosystem: A vibrant developer community and a rich ecosystem of tools and resources can facilitate development and innovation.

Some popular blockchain platforms for ETOs include:

Ethereum: A widely used and established platform with a mature ecosystem.

Binance Smart Chain: Known for its fast transaction speeds and low transaction fees.

Polygon: A scalable and interoperable platform that addresses some of Ethereum’s limitations.

Solana: A high-performance platform known for its speed and scalability.

Choosing the right blockchain platform is a critical decision that will have a significant impact on the success of your ETO.

Important Note: This information is for general knowledge and educational purposes only. It does not constitute financial, legal, or investment advice. Always conduct thorough research and consult with qualified professionals before making any investment decisions.