A Digital Wallet with Expense Analysis

TEAM (6 Members)

Project Manager | Developers | Designers | QA

TIMELINE (10 Weeks)

Project Manager | Developers | Designers | QA

INDUSTRY (Digital Payments)

fintech application

Platform

Web | Android | iOS

Project Manager | Developers | Designers | QA

Project Manager | Developers | Designers | QA

fintech application

Web | Android | iOS

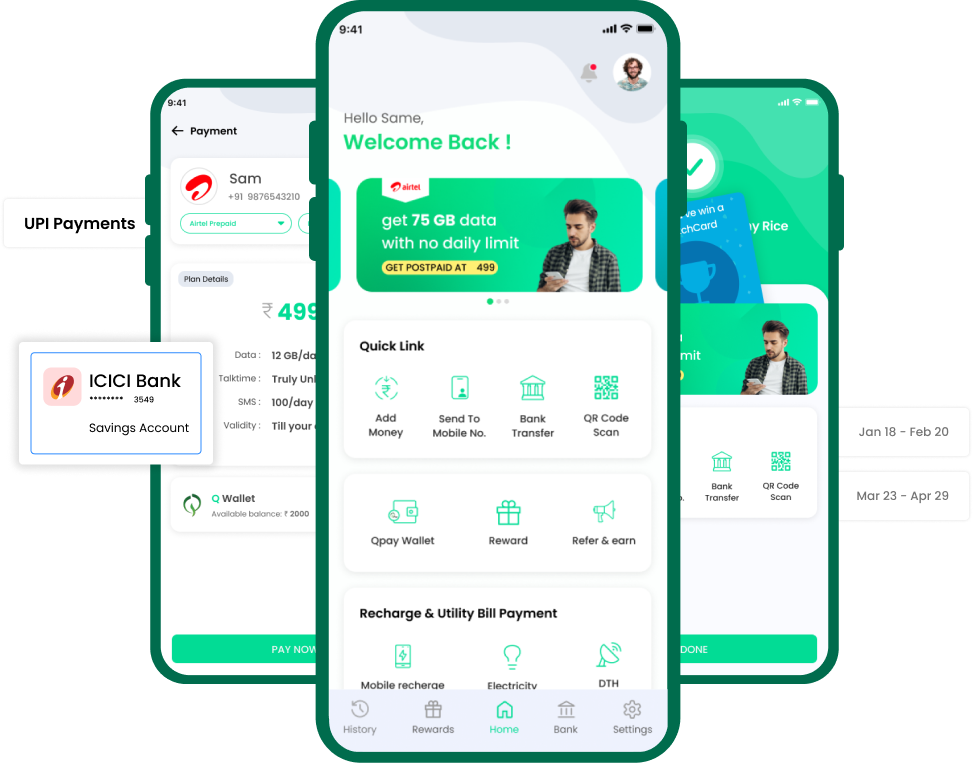

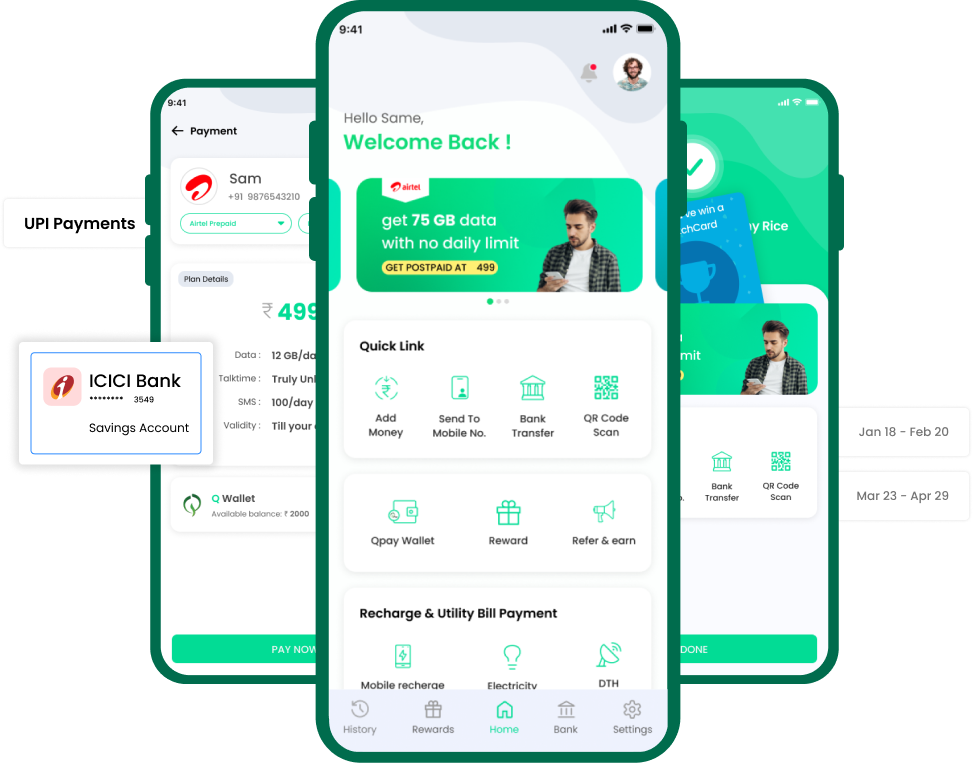

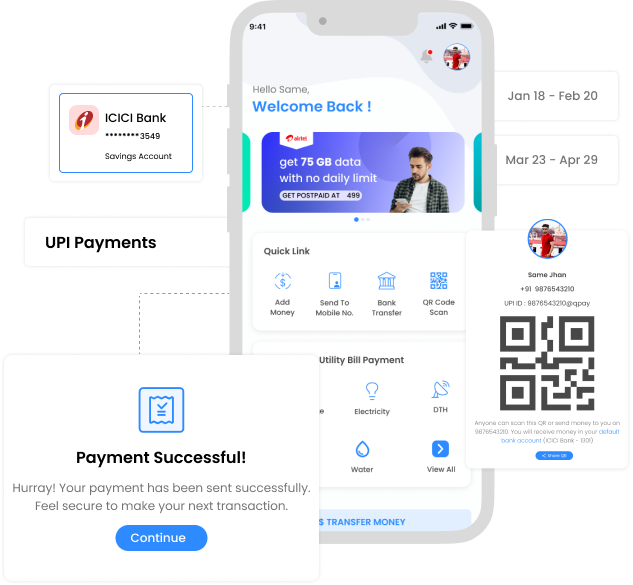

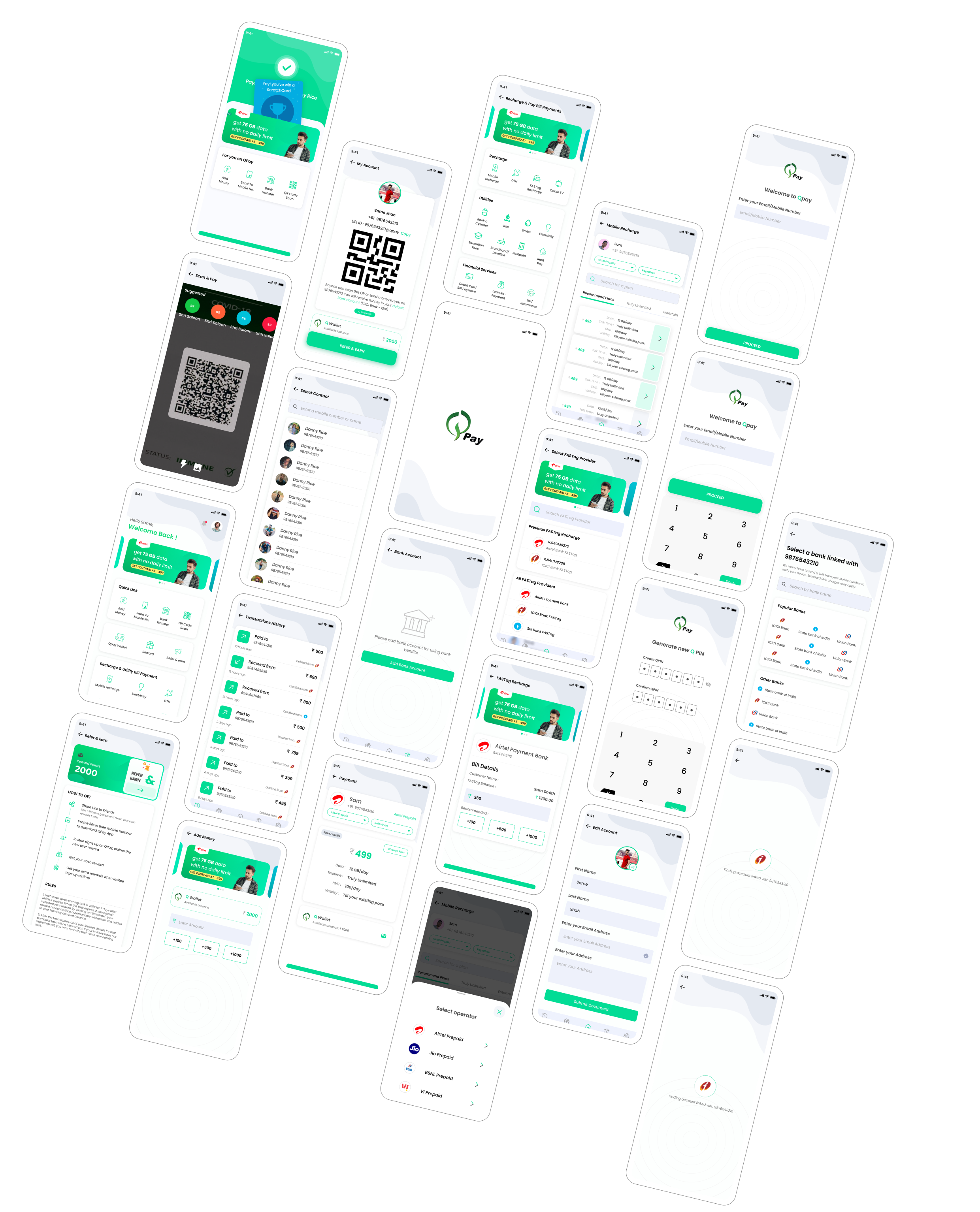

QPay is a fintech application built with the dedicated developers from MyCloudPulse.QPay is an all in one digital payment partner operated by Qax Tech Pvt. Lmt. It is designed to simplify and secure digital payments for individuals and businesses. This IT project is intended to bridge the gap between the usage problems in urban-rural digital app. In the revolutionizing booming digital finance ecosystem QueePay is an app that drives financial inclusion, real-time payments in a cashless economy.

The objective is to create a cashless, digital economy where all transactions are safe, quick, and accessible to everyone, regardless of location.

The objective was to build a secure and scalable, seamless mobile transactions mobile payment app.

QueePay aims to solve the following challenges or issues faced by the users through its smooth functioning of the features.

Leverage our expertise in fintech app development to launch a robust, scalable, and secure digital wallet.

QueePay is focused to provide its services in the backward regions. People from rural areas are not able to use the digital payment methods, so the app provides agents to resolve the problem.

Failed transactions, duplicate payments, incorrect bill payments, refund delays.

Problem with account access, profile updates, or data deletion requests.

Disruption in service availability, tech glitches.

Businesses needed an app that is safe, secure, and user-friendly, reducing transaction friction while staying compliant with evolving digital finance regulations.

The biggest problem that digital payment apps face is that the people from rural areas are not able to use the app due to lack of knowledge.

E-Wallet apps face major issues in transactions like failed transactions, duplicate payments, incorrect bill payments, refund delays.

Challenges like problems with account access, profile updates and data deletion requests are faced in day-to-day transactions.

Some errors or glitches occur at the time of the service of transaction. Issues like problems with functioning of the app or any of its features. Lagging of a feature or a transaction in between is a challenge.

QPay aims to solve the problem of backwardness in digitalisation in payments. There are agents for improving the situation in rural areas. Agents work on providing knowledge to the people.

Our app works on issues faced in transactions, like failed transactions, duplicate payments, incorrect bill payments, refund delays, by providing “Dispute” or “Report a Problem” feature to flag a specific transaction.

Problems with account access, profile updates and data deletion requests are looked after. Email details and transaction IDs to QPay’s support team if the dispute isn’t resolved.

Disruptions in service availability are noted and improved. Tech glitches are instantly solved on a request. If the issue relates to BBPS payments, you can escalate to MobiKwik or Cashfree

Queepay aims to tap into this market with a user-first mobile app offering a unique blend of simplicity and robust backend infrastructure. Factors such as increased smartphone penetration, UPI adoption, and government initiatives toward financial inclusion are fueling this growth.

There are some existing system gaps in the project: Most existing apps fail to seamlessly combine UPI, Wallet, and Bank Transfer functionalities in a single interface, leading to fragmented user experiences.

Poor UI/UX Across Platforms- Many digital wallets and payment apps suffer from cluttered interfaces, non-intuitive flows, and inconsistent support for regional users or feature phone users.

There is limited support for Micro, Small, and Medium Enterprises (MSMEs), and current platforms inadequately serve small merchants, local agents, and rural business owners, missing out on a massive user segment in need of digitized financial tools.

The scope of this project is centered around the development of a user-friendly android mobile application for QueePay, designed to facilitate seamless digital payments.

Send or request funds via India’s UPI network with instant real-time inter-bank transfers.

Pay merchants using biometric authentication that is aadhar based wallet convenience.

One stop pay portal for electricity, water, gas, broadband, mobile, DTH, etc., via Bharat Bill Payment System.

Top up prepaid/postpaid, renew subscriptions through the app.

Cash deposits and withdrawals via QPay agents, acting like a mini ATM.

Cash deposits and withdrawals via QPay agents,acting like a mini ATM.

Accept UPI/AEPS/QR-based digital payments at offline stores, restaurants, taxis & more.

Earn commission by helping customers with bill payments or wallet top-ups.

Disburse cash from customer wallets, again earning commission

Additionally, an admin dashboard will be developed to enable real-time monitoring, analytics, and system control by the internal operations team.

Currently the project excludes development for iOS devices, it is planned for future release. Also the app does not support international currency transactions, it is a domestic INR based project.

Since its launch, the QueePay app has achieved significant milestones, including over 25,000 downloads within the first three months, a remarkable 99.8% transaction success rate, and a 4.7-star rating on the Google Play Store. The app's intuitive user interface and instant payment confirmation have contributed to high user retention and positive user sentiment. From a business perspective, QueePay has reduced manual payment errors, accelerated peer-to-peer (P2P) and business-to-business (B2B) micro-transactions, and successfully expanded digital payment adoption in rural and semi-urban areas, aligning with its goal of inclusive financial access.

Throughout the project, several practices proved highly effective in ensuring smooth execution and user satisfaction. Regular reviews and iterative updates allowed the team to remain agile and responsive to feedback. The emphasis on a user-centric design approach significantly enhanced the overall user experience, contributing to high engagement and retention. Additionally, Firebase integration played a crucial role in supporting real-time data handling and ensuring the app's scalability as the user base grew.

However, there were also areas identified for improvement. Earlier integration with banking APIs could have streamlined UPI and wallet functionalities during the initial release phase, reducing time-to-market. Furthermore, the absence of an iOS version at launch limited accessibility for a segment of potential users, highlighting the need to prioritize cross-platform development in future phases.

QueePay’s success lies in its ability to combine speed, security, and simplicity . QPay conducts VAPT (Vulnerability Assessment Penetration Testing) to identify and address security risks. This makes the app user-friendly. The services of this app are available for all ages, even for children. As digital transactions continue to grow, platforms like QueePay need to be agile and proactive in adapting to new user demands and compliance landscapes.

Discover how we built a seamless digital wallet experience with advanced security, intuitive UI, and scalable architecture.

Ready to develop a similar app?

Talk to Our Experts

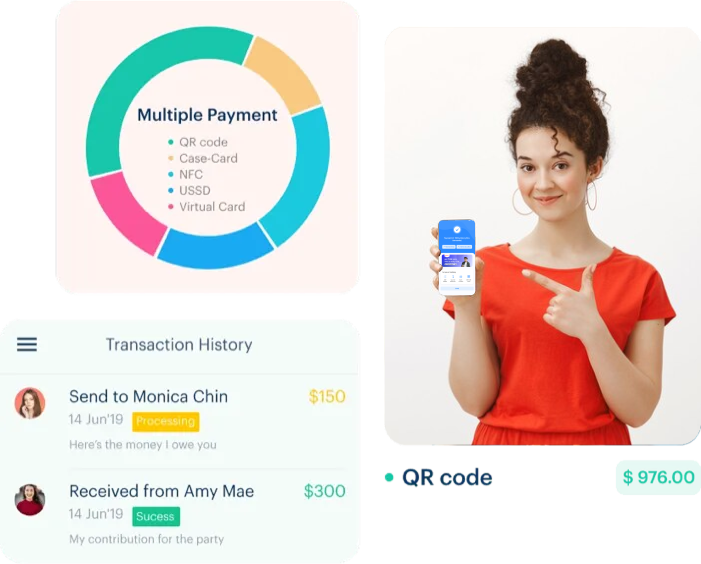

QPay features a clean, modern visual design with intuitive navigation, vibrant accent colors, and minimalistic icons. Its user interface emphasizes ease of use, trust, and fast transactions.

QPay is built using a robust and secure technology stack to ensure fast, reliable, and scalable digital wallet operations. It leverages modern frameworks, cloud infrastructure, and secure payment protocols to provide seamless transactions and real-time financial services.

CloudPulse is a team of enthusiastic tech geeks who are masters of their fields and are passionate about the development technologies. We have ventured with some of the renowned businesses around the globe and understand the needs of the international clients well.

CloudPulse aims to bridge the gap between skilled developers and companies requiring talent with a blended-shore approach. We believe no company should miss opportunities to scale up with new products or clients.

Years of Experience

Happy Customers

Active Accounts

Projects Delivered

Expert Members

Countries Served

Being a leading IT services provider, we offer custom IT solutions for a wide range of industries, including:

Reach out and we will get in touch within 24 hours.