There has been a digital revolution in the financial scene. Leading the charge in this transformation are applications such as LendingClub. They are revolutionizing the way people handle their money and get loans.

Borrowers and lenders may connect via these channels. They make getting a loan easier. When it comes to money, they’re a whole different ball game.

If you are planning to develop an app like LendingClub, we have a detailed guide for you. In this blog post, we’ll discuss what it takes to build an app like LendingClub, including its features, revenue models, development process, technology stack required, and the cost of development. Let’s begin:

Key Stats and Insights about LendingClub

If you are not certain if investing to develop an app like LendingClub is worth it, here we have some stats to give you a boost:

- Between 2017 and 2023, the projected number of American users of online banking rose, and by 2023, it will have surpassed 52 million. It is projected to reach 80 million by 2028 as well.

- Revenue for the US-based lending platform LendingClub reached 314.7 million USD in 2020. In this case, December 31st is the conclusion of the reported fiscal year.

- More than five million people have downloaded the Club app and have been using it to help them achieve their financial goals since 2007.

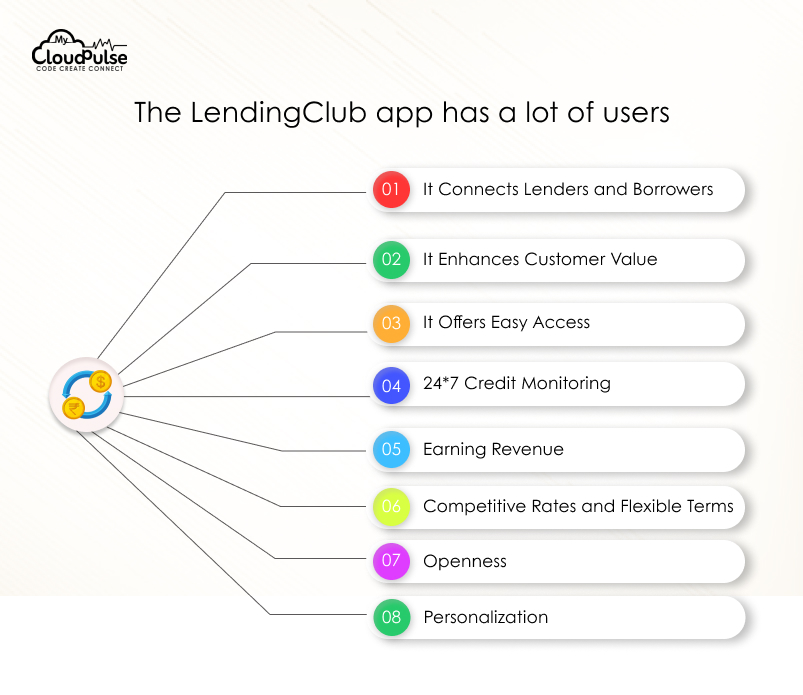

The LendingClub app has a lot of users, but why is that?

There are a handful of loan lending apps available in the market, but LendingClub has a distinctive place among them all. Here are the reasons:

1. It Connects Lenders and Borrowers

The application acts as a bridge between borrowers and lenders, bringing together those in need of loans and those willing to provide them. With this direct link, middlemen are eliminated. A quicker loan approval is the result. A more effective system is provided by it. A more open market is the result of this strategy.

2. It Enhances Customer Value

Customers benefit from more value due to quicker approvals and better pricing. The app improves the whole banking process and offers helpful resources for managing one’s finances. People can use services that were previously unavailable to them.

3. It Offers Easy Access

Customers may use their cell phones to access banking services, including loan applications and account management. This enhances the ease of everyday living, as users may control their funds from any location.

4. 24*7 Credit Monitoring

The software offers round-the-clock credit monitoring. Customers are always up-to-date on their credit report. Rapid adaptation is within their capabilities. Users may keep their finances in good shape with this proactive strategy.

5. Earning Revenue

Investors get their money’s worth. Because of this, they find the app appealing. An investment opportunity is presented. This results in an environment where both parties may thrive.

6. Competitive Rates and Flexible Terms

Rates that rival those of conventional banks are available on LendingClub, and the terms are flexible as well. You may choose from a variety of repayment plans. It provides options for consumers. With this software, managing your money is a breeze. It offers monetary leeway as well. Customers love the independence it gives them. This software is very helpful.

7. Openness

All fees and conditions are visible to users. This fosters confidence. As a result, users are prepared. User trust is enhanced by this openness.

8. Personalization

The application often offers suggestions based on the user’s unique characteristics. Individual demands are met by customizing services. The user benefits from this.

How Does the LendingClub App Work?

Simplicity is the biggest feature of LendingClub. It works in such a simple way that even a novice user can use it comfortably. Here is how this app works:

1. Installation and Registration

The user installs the application by downloading it from the app store on their mobile device. They fill out the required fields to establish an account. This encompasses both private and financial details. An easy-to-understand registration procedure is in place.

2. Application For Loan

Borrowers apply for loans by completing an online application. Important paperwork is turned in by them. Verification of income and credit history may be part of this process. This step walks consumers through the app.

3. Select a Loan Offer

After you submit your application, the app will show you several loan options. In this step, borrowers examine the rates and conditions. They choose the deal that works for them. Tools for comparing deals are available in the app.

4. Complete the Application Process

Borrowers finish the application process by entering the required details. All information is confirmed by them. They will provide any further data needed. Accuracy is guaranteed by this procedure.

5. Waiting For Approval

While you wait for approval, the app will process your application. There is a waiting period for loan approval. Everything is more organized. The design prioritizes efficiency. A user’s status may be notified by the app. The procedure is created with the user in mind. Updates are provided by the app.

6. Disbursement

Funds are disbursed after the loan is approved. The user’s bank account is credited with the amount. It doesn’t take long at all.

7. Repayment

For loan repayments, users may use the app. Automatic payments can be set up. The repayment procedure is made easier by this.

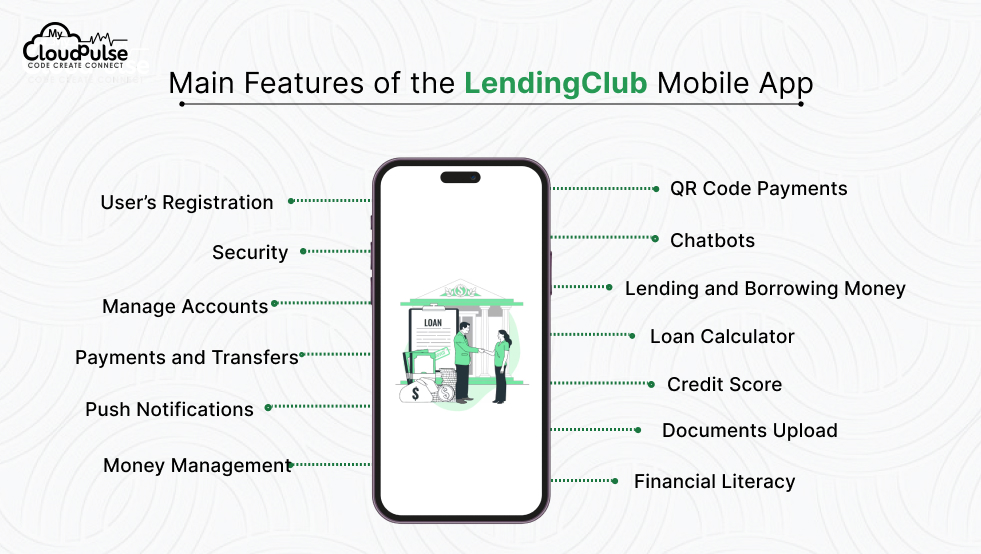

Main Features of the LendingClub Mobile App

The selection of the features is what makes any application great. If you are planning to develop an app like LendingClub, here are several must-have features to consider:

a. User’s Registration

A streamlined sign-up procedure enables the rapid establishment of an account. For first-time users, this is a huge help. The program may be used by them in no time at all. It is important to make sure the method is easy to use.

b. Security

User data and transactions are protected by robust security mechanisms. This fosters confidence. Private data is safeguarded. Safety must always come first.

c. Manage Accounts

Users can examine their balances and transaction history using the Manage Accounts functionality. You get command of your finances using this. All account information is accessible to users.

d. Payments and Transfers

Customers have the option to pay back their loans. Between accounts, they may move money. This streamlines monetary dealings. Multiple payment methods are available inside the app.

e. Push Notifications

Notifications regarding the status of loans and reminders to pay them are sent to users using push notifications. It aids in their fiscal management. Notifications must be provided promptly.

f. Money Management

Tools for money management allow users to keep tabs on their spending and set up budgets. They have a good grasp of money matters. This is useful for budgeting. Financial insights are provided via the app.

g. QR Code Payments

Users have the option to pay using a QR code. Another payment method is now available. Additional ease is provided by this. This function increases adaptability.

h. Chatbots

Instantaneous assistance is provided by chatbots. User inquiries are addressed by them. You can get help right now with this. Help is available to users at any time.

i. Lending and Borrowing Money

The application facilitates financial transactions by linking borrowers and lenders. This function is fundamental. Financial transactions are made easier by it. The function of the app relies on this feature.

j. Loan Calculator

Payments for loans may be calculated using this tool. Their financial plans are aided by this. Decisions may be made with knowledge. When making plans, this tool is helpful.

k. Credit Score

The application keeps an eye on your credit score. Users are notified of any changes. Users can keep their credit strong using this.

l. Documents Upload

Users may submit necessary papers by uploading them. Among them are the financial statements. The application procedure is made easier with this feature.

m. Financial Literacy

The app offers instructional materials for financial education. With this, consumers may become more financially literate. Users benefit from this.

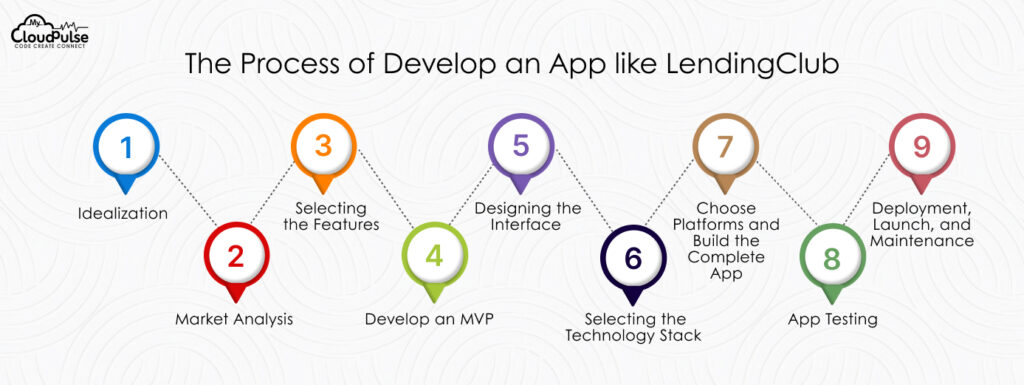

The Process of Develop an App like LendingClub

Now, let’s come to the main part of the process – how to develop an app like LendingClub. We have described several steps that one must follow to develop a feature-rich application:

Step 1: Idealization

As a first step, you should define the app’s goal. Figure out who you’re writing for. Lay forth the essentials. The foundation must be laid at this stage.

Step 2: Market Analysis

Find out who your rivals are. Seek out patterns in the market. Gain a familiarity with user requirements. That way, the software will always be relevant and suit user needs.

Step 3: Selecting the Features

Third, choose the features. Figure out what’s really important. Users should be given first priority. Stay focused on what you do best. User engagement and pleasure are both enhanced by this.

Step 4: Develop an MVP

Fourth, create a minimal viable product (MVP). Try out the essential features. Collect feedback from users. By doing so, you can improve the application and check the assumptions.

Step 5: Designing the Interface

Make sure the interface is easy to use. Keep the user experience in mind. Maintain an organized layout. As a result, user engagement and retention are enhanced.

Step 6: Selecting the Technology Stack

Selecting the Technology Stack is the Sixth Step. Pick the Correct Technologies. Keep scalability in mind. Give some thought to safety. The app’s robustness and reliability are guaranteed by this.

Step 7: Choose Platforms and Build the Complete App

Make your platform choices and develop the app in step 7. Create an app that works on both Android and iOS. Guarantee compatibility across many platforms. More people will see this.

Step 8: App Testing

Give the app a full rundown. Crawl for and eliminate error messages. Make sure everything runs well. This guarantees quality and avoids problems after launch.

Step 9: Deployment, Launch, and Maintenance

Next step is deploying, launching, and maintaining the App. Open the app. Continue to assist. The app needs frequent updates. As a result, the app remains up-to-date and safe.

Tech-Stack to Develop an App Like LendingClub

Lending applications often make use of the following technological stacks:

- Front-End Development: React Native, Swift, and Kotlin. These provide seamless user interfaces and the ability to work on many platforms.

- Back-End Development: Node.js, Python, and Java. The logic and data processing on the server side are handled by them.

- Databases: Secure and efficient data storage and management are provided by databases such as PostgreSQL and MySQL.

- Cloud Services: Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are all in the cloud. For services hosted in the cloud, they provide scalability, dependability, and safety.

- Security: encryption, OAuth, and SSL. These guarantee safe transactions and safeguard confidential information.

- APIs: RESTful APIs. These let the app’s many components communicate with third-party services without any hitches.

- SDKs: a payment gateway and analytics packages. These features are crucial for the app’s operation. The reliability and safety required by financial applications are provided by these technologies. The needs of the application dictate the stack to be used.

Problems with and Solutions to Building an App Similar to LendingClub

Since an application like LendingClub deals in the financial sector, there are certain challenges you may face during the development phase. Here, we discuss these challenges along with possible solutions:

1. Problems with Security

The possibility of data breaches exists. Implement robust encryption. Take precautions to ensure safety. We must conduct security audits regularly. Adherence to norms set by the industry is critical.

2. Negligible Market Research

Failed attempts at market analysis result in failure. Find out everything you can. Gain a familiarity with user requirements. Evaluate current market tendencies. Apply insights derived from data.

3. Bad App Design

People Don’t Use It Because It Looks Bad. Prioritize your users’ experience. Develop an easy-to-navigate user interface. You can’t skip usability testing. Purchase user interface and experience design.

4. Regulatory Compliances

Financial applications are subject to stringent rules. Know the latest legislation. Seek the advice of attorneys. Check for conformity. This calls for a consistent focus.

5. Financial Literacy

Users may not be well-versed in financial matters. We provide instructional resources. Provide concise details. Incorporate guides. Explain money more simply.

6. Scalability

To be scalable, the software must be able to manage growing numbers of users. One useful thing is cloud solutions. From the very beginning, plan for scalability.

7. User Trust

Establishing trust with users is crucial. Effective communication is crucial. Be forthright with your details. Provide first-rate assistance to clients.

8. Lack of Innovation

The fintech industry is very competitive. It is critical to differentiate. Make a special offer. Never stop innovating.

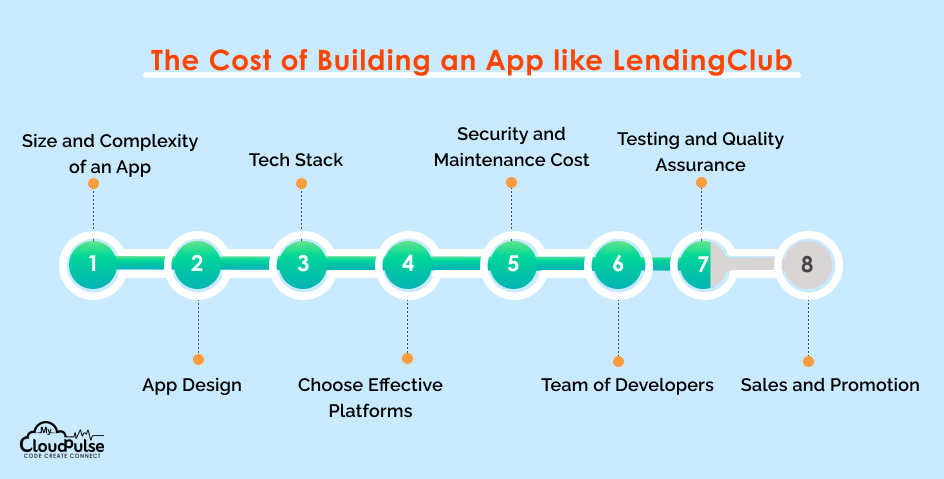

The Cost to Develop an App like LendingClub

Now, let’s discuss the investment you would need to make. Developing an application involves some cost, which may depend upon several factors, such as:

1. Size and Complexity of an App

Adding more functionality makes the app more expensive. Cheaper applications are simpler. The feature count affects the price. Personalized features come at a higher price.

2. App Design

Custom designs for apps tend to be more expensive. The standard designs are more affordable. Extra effort and knowledge are needed for one-of-a-kind designs.

3. Tech Stack

Developing using advanced technology is more expensive. Reduced prices for basic stacks. More money is needed to purchase specialized technology. Think about the price of a license.

4. Choose Effective Platforms

It’s more expensive to develop for both Android and iOS. Simultaneously developing for several platforms saves money. Costs may be reduced with cross-platform development.

5. Security and Maintenance Cost

Robust security measures and continuous maintenance incur additional expenses. There should be frequent updates. It is crucial to conduct security audits.

6. Team of Developers

Skilled programmers command a premium. Cheaper developers with less expertise are available. The location of the team affects the cost. Whether a team is in-house or outsourced also affects cost.

7. Testing and Quality Assurance

The importance of testing and quality assurance cannot be overstated. This raises the price tag, but it guards against problems after the launch.

8. Sales and Promotion

Sales and promotional budget. In order to get users, this is crucial. Depending on these parameters, the price changes. Planning one’s budget is crucial. Compare prices.

What is LendingClub’s Revenue Model?

LendingClub is a highly profitable business, making millions of dollars every month. They follow several revenue models, which you may also consider implementing in your application. Here are some of the ways they make money:

a. Transaction Fees

Loan transactions on LendingClub incur transaction fees. The majority of our income comes from this. Borrowers and investors both pay fees. Their business strategy is built on these fees.

b. Cross-Selling of Financial Products

Insurance and other financial goods are available for cross-selling on the site. This results in more revenue. This may be achieved via collaborations with other businesses. This broadens their sources of income.

c. In-App Advertising

Displaying advertisements inside the app is one way to generate cash. This is a typical method of making money. You may boost your income with targeted adverts.

d. Management Fees

Funds managed for investors are subject to management fees. Investment services might earn money from this. For their pool of potential investors, this is crucial.

e. Loans and Credit Interest

Borrowing money generates interest income. This generates a substantial amount of money. Interest rates have a crucial role.

f. Data Monetization

Analyzing data yields valuable insights. It is possible to sell these insights to other parties. The income from this source is increasing. It is essential to take privacy into account.

g. Strategic Alliances

Strategic alliances generate revenue. The platform’s reach is expanded via these agreements. They open doors to untapped marketplaces.

h. Subscription Fee

Offering premium benefits via subscriptions is what subscription services are all about. This generates income on an ongoing basis.

How to Develop an App like LendingClub with the Help of MyCloudPulse

Our team at MyCloudPulse is very skilled in creating apps. Financial technology is an area in which we have proficiency. Tailored solutions are what we provide. If you want to create a loan lending app, we can assist you. We are here to help you every step of the way.

We have a workforce that is well-versed in the financial sector. We provide both business and technical knowledge. Together, we will strategize and carry out the project. Superior outcomes are guaranteed by us. Our development services cover every step of the process. Security and compliance are our primary concerns. We provide continuous assistance. Regarding advertising, we can provide a hand. We make sure your app is suitable for the market.

Interested in working with us? Contact us today to discuss your app idea, and we’ll help you convert your idea into a profitable business.

Frequently Asked Questions

Answer: Everything from creating an account to managing it, uploading documents, checking credit scores, collecting payments, and providing financial education to users. A fully working app must have these qualities.

Answer: Complexity and features determine costs. Anticipate a diverse array. Design, technology, team size, and security are some of the factors that impact the pricing. It is essential to plan a budget.

Answer: Most people go with Node.js, PostgreSQL, or React Native. You get scalability and security using these technologies. Consider the app’s requirements and budget before deciding on the stack.

Answer: Always adhere to rules, do regular security audits, encrypt sensitive data, and protect APIs. Adherence to norms set by the industry is critical. Important information must be kept private.

Answer: Rules differ. Seek the advice of attorneys. Follow all applicable state and federal regulations. There is a great deal of complexity and ongoing change in financial legislation. It is critical to be informed. It is critical to adhere to legislation such as GDPR and CCPA.