In today’s fast-paced digital world, managing unexpected financial emergencies has become significantly easier with the rise of mobile cash loan applications. Among the leading platforms in the UAE is CashNow, a user-friendly app that offers instant personal loans with minimal documentation. The app has gained substantial traction due to its speed, convenience, and transparent loan terms. If you’re looking to enter the growing digital lending space, it’s the perfect time to develop a cash loan app like CashNow—one that combines seamless user experience with robust financial features.

If you’re a fintech startup, a financial institution, or an entrepreneur eyeing the digital lending space, this comprehensive guide will walk you through how to develop a cash loan app like CashNow, from core features and monetization to development and compliance.

Introduction

Mobile lending is transforming the way individuals access credit. Traditional loan approval processes are often lengthy and restrictive, especially for those without extensive credit histories. Mobile loan apps like CashNow offer a digital-first solution by automating the entire lending process—from application and verification to disbursal and repayment.

CashNow has emerged as a go-to financial tool for UAE residents, offering loans up to AED 5,000 with quick turnaround times. The app’s model can be replicated in other markets with similar financial infrastructures and a high population of smartphone users. Understanding what makes CashNow effective is the first step toward building a similar app tailored to your market.

App Stats

Before diving into the development process, it’s important to understand the performance and structure of CashNow to get a sense of market readiness and user expectations.

- Developer: Quantix Technology Projects LLC

- Platform: Android (Google Play Store)

- Region: United Arab Emirates

- Category: Finance

- Licensing: Approved by the Central Bank of UAE

- Download Range: Over 100,000 installs

- User Ratings: 4.5+ stars, based on user feedback

- Loan Limit: AED 500 – AED 5,000

- Repayment Duration: 91 to 180 days

- APR Range: Up to 35.9%

- Supported Banks: All major UAE banks including Emirates NBD, First Abu Dhabi Bank, RAKBANK, ADCB, and Mashreq

The numbers reflect a well-functioning, highly compliant fintech product serving a niche yet scalable market. These statistics will help you benchmark your own product.

Key Highlights

Several core characteristics make CashNow stand out as a successful mobile cash loan app:

Regulatory Compliance

CashNow operates under the regulatory framework of the Central Bank of UAE, which increases user trust and ensures the app follows ethical lending practices. A license from a central authority is not just a badge of credibility but a necessity for scaling.

Instant Cash Transfers

Unlike BNPL platforms that delay actual payments, CashNow ensures direct cash disbursal to the user’s bank account or digital wallet. This is a vital feature that satisfies the immediate need for liquidity.

Minimal Requirements

The application process is designed to be frictionless. Only a valid Emirates ID, a personal bank account, and a UAE residence status are required. The app does not demand salary slips or extensive documentation.

Open Eligibility

CashNow caters to UAE residents of all nationalities. This inclusivity broadens the app’s market reach and ensures higher adoption rates.

Transparent Loan Terms

From interest rates and processing fees to total repayment and APR, every aspect of the loan is disclosed upfront, eliminating any unpleasant surprises for the borrower.

Essential Features to Develop a Cash Loan App Like CashNow

To replicate the success of CashNow, your app must include these fundamental features:

User Registration and Login

A simple onboarding process via mobile number and OTP ensures accessibility. Linking social media or email accounts can enhance user convenience.

Identity Verification (KYC)

KYC is a must for compliance and fraud prevention. Enable users to upload their Emirates ID, take a selfie for facial verification, and input personal details securely.

Loan Application Interface

Allow users to select loan amount, repayment period, and input basic financial data. Ensure the interface is user-friendly and mobile-responsive.

Loan Calculator

Give users the ability to calculate EMIs, interest, processing fees, and total repayment before applying. This increases transparency and trust.

Document Upload

Let users scan and upload their Emirates ID or any other required documents. Use OCR to extract information and auto-fill fields.

Credit Scoring Algorithm

Integrate a scoring engine that evaluates user eligibility based on KYC, credit bureau reports, and digital behavior patterns.

Loan Disbursal & Tracking

After approval, disburse the loan directly to a bank account or wallet. Users should be able to track application and payment status in real-time.

Notifications & Alerts

Send push notifications and emails to inform users about loan approval, disbursement, upcoming EMIs, and overdue payments.

Customer Support

Offer in-app chat, FAQs, and ticketing systems to handle queries and issues promptly.

Advanced Features

AI-Powered Risk Assessment

Use machine learning models to assess risk based on spending habits, location patterns, phone metadata, and past repayment behavior.

Biometric Login

Enable fingerprint or facial recognition for faster and more secure access to the app.

Multi-Language Interface

Support for Arabic, English, Hindi, and other languages spoken by UAE residents can greatly enhance usability.

Loan Renewal and Top-Up

Allow loyal users to extend, renew, or top-up their loans based on their repayment history and updated credit assessment.

Gamified Credit Building

Encourage responsible financial behavior by awarding points or badges for timely repayments, which could also reduce interest rates in the future.

Budgeting Tools

Add features like budgeting calculators or expense tracking to enhance user engagement and help users manage finances better.

Monetization Models

Interest Rates

Charging annual or monthly interest on loans is the primary revenue stream. The rate can vary based on user risk category.

Processing Fees

A flat or variable processing fee (e.g., 5%) deducted at disbursal adds an immediate cash flow stream.

Late Payment Penalties

Penalty fees for late EMI payments can deter delays while also serving as a revenue channel.

Subscription Models

Offer premium features like higher loan limits or longer tenures under a subscription model.

Cross-Selling

Use the app to cross-sell insurance, credit cards, and investment tools and earn affiliate or commission income.

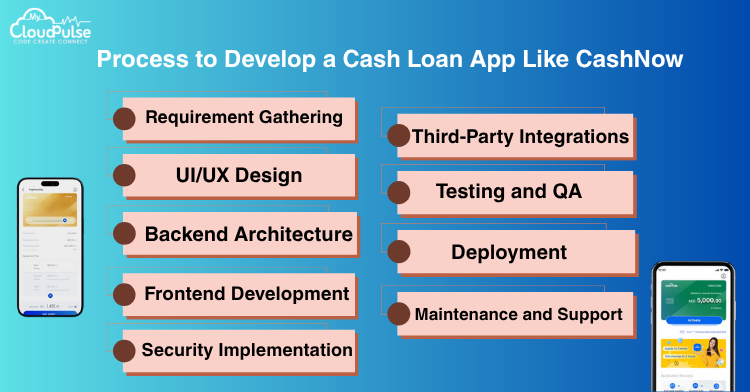

Process to Develop a Cash Loan App Like CashNow

Step 1: Requirement Gathering

Understand your target users, compliance regulations, and technical needs. Consult legal advisors to ensure regulatory alignment.

Step 2: UI/UX Design

Design a seamless interface with wireframes and clickable prototypes. Prioritize simplicity and mobile responsiveness.

Step 3: Backend Architecture

Develop robust APIs for user management, document verification, loan processing, and bank integration.

Step 4: Frontend Development

Use Flutter or React Native to develop apps for both Android and iOS with a shared codebase.

Step 5: Security Implementation

Apply SSL, AES encryption, biometric authentication, and secure cloud storage to protect user data.

Step 6: Third-Party Integrations

Integrate with banks, credit bureaus, KYC services, and payment gateways using their APIs.

Step 7: Testing and QA

Conduct unit, integration, and load testing to ensure performance across devices and networks.

Step 8: Deployment

Deploy apps on Google Play and Apple App Store. Use CI/CD tools for continuous updates.

Step 9: Maintenance and Support

Offer regular updates, performance enhancements, and 24/7 technical support post-launch.

Cost to Develop a Cash Loan App Like CashNow

The cost of developing a loan app like CashNow depends on features, complexity, and geographic location of your dev team:

| Component | Estimated Cost (USD) |

| UI/UX Design | $5,000 – $10,000 |

| Android/iOS Development | $15,000 – $30,000 |

| Backend/API Development | $10,000 – $20,000 |

| Admin Dashboard | $5,000 – $8,000 |

| Security Implementation | $3,000 – $6,000 |

| Third-Party Integration | $3,000 – $7,000 |

| Testing and QA | $2,000 – $5,000 |

| Ongoing Maintenance | $5,000 – $10,000/year |

| Total Estimate | $40,000 – $90,000 |

Team Structure

To build a feature-rich and compliant loan app, the ideal team includes:

- Product Manager: Oversees planning, development, and delivery

- UI/UX Designer: Crafts intuitive and appealing user experiences

- Mobile Developers: Build Android and iOS applications

- Backend Developers: Handle APIs, databases, and integrations

- QA Engineers: Conduct manual and automated testing

- DevOps Engineer: Manages deployment and cloud operations

- Legal/Compliance Advisor: Ensures app meets regulatory standards

- Customer Support Agents: Handle real-time user queries and issues

Conclusion

Creating a cash loan app like CashNow is both a technical and strategic challenge. It requires a thorough understanding of user needs, compliance laws, financial modeling, and scalable architecture. With the right team, features, and market strategy, you can create a robust lending solution that offers real value to users while ensuring profitability and regulatory adherence.

As digital finance continues to evolve, being a pioneer in mobile lending can unlock significant opportunities in emerging markets. Focus on building trust, providing transparency, and delivering value, and your app can replicate—and even surpass—the success of CashNow.

FAQs

Yes, but you must obtain the required licenses and approvals from your country’s central financial authority. Compliance with KYC, AML, and data protection laws is mandatory.

Depending on complexity and team size, developing a full-fledged MVP can take between 4 to 6 months. A feature-rich app may take up to 9 months.

Yes, to enable real-time disbursals and repayments, bank API integration is essential. This also ensures the app remains competitive and user-friendly.

Yes, as long as your app meets the regulatory requirements and has a digital KYC process, you can operate entirely online.

For the frontend, Flutter or React Native are good choices. Backend can be built using Node.js or Django. Use AWS or Google Cloud for infrastructure, and Firebase for notifications and analytics.