In today’s dynamic, one can need financial assistance and quick monetary help at any instance. If there are unexpected financial issues, the traditional banking systems or finance systems are of no help if things are required immediately. That’s where the cash advance apps like FloatMe comes. The cash advance app development like FloatMe is bridging the gap between paychecks and helping people restore their finances.

If you are an aspiring entrepreneur who wants to enter the fintech industry, then developing an app like FloatMe can help you expedite the process. In this article, we will go through each major stage of FloatMe like Cash Advance App development.

What is the FloatMe Cash Advance App?

Any cash advance app like FloatMe helps users obtain the necessary funds required just before their paycheck. The users get the financial mobility with these apps and it closes the gap between paychecks. The working methodology is quite straightforward: when the users link their bank account to the app, the cash advance app starts analyzing their spending and income. This data further helps to calculate how much money customers require in advance.

Users can request money directly from the app. Within a few minutes, they will get the requested cash into their bank account(s). Thus, they don’t have to bear unforeseen circumstances due to any financial difficulty. It is a practical and reliable solution for the immediate financial needs. Also, users don’t need to turn to conventional loans or credit cards.

Why is Cash Advance App Development in trend?

In today’s time, there are a lot of people who require immediate cash before their salary gets credited. With a cash advance app, they will get quick access to small sums of money. Generally, this cash is in the form of a payday loan. By leveraging advanced technology, and data analysis, the app will access the financial situation of the users and determine whether they qualify for a cash loan. The money is then given to the user’s bank account.

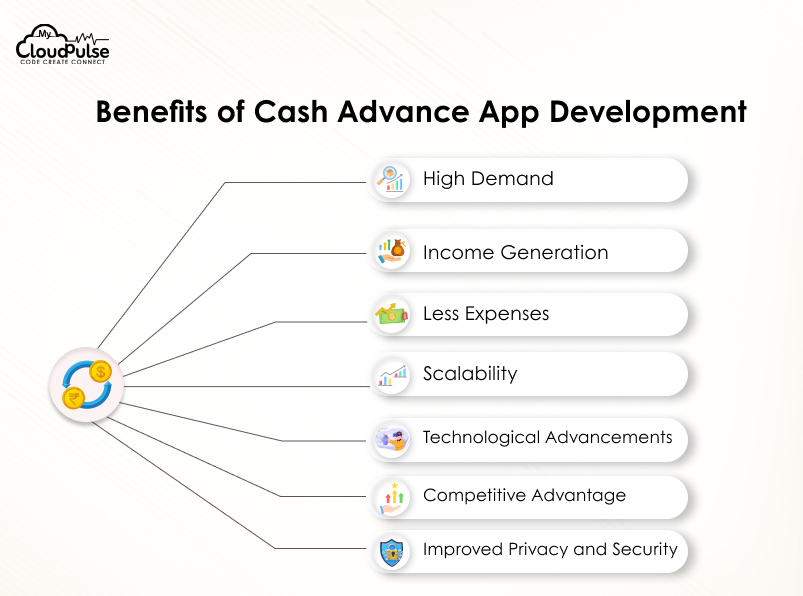

Benefits of Cash Advance App Development:

Here are some of the major benefits of Cash Advance App Development:

1. High Demand:

Every entrepreneur must check the demand for the product before making any huge investment. In today’s time, people are finding trustworthy and practical solutions to help manage the financial gaps. That’s why the demand for immediate cash solutions is quickly rising. This expanding market can be leveraged by meeting the requirements of millions of users.

2. Income Generation:

There is a straightforward business idea behind the apps like FloatMe. The users can borrow money through instant access to small loans which will be repaid with a certain fee or interest after their next paycheck arrives. The app owner can make money from this fee or the interest. A well-designed with a trusted user base has the potential to generate a lot of money.

3. Less Expenses:

In comparison to launching a traditional loan lending organization, it is much cheaper to develop a cash advance app. You are not required to incur daily expenses plus you don’t need to maintain a sizable staff to manage operations. The app will automate the entire process, from loan application to loan disbursement or repayment. There will be reduced expenses and increased profit margins.

4. Scalability:

Another major benefit of cash advance app development is high scalability. You can reach a global audience who is looking for immediate cash through your app. You can get new investors, expand your business, and boost profitability with the growth of your user base.

5. Technological Advancements:

With AI development, there have been significant improvements in the financial industry development. You can improve user experience, and expedite the loan approval process, by implementing certain AI-based technologies into the app. You can further evaluate credit worthiness, fraud detection, and customize loan options using AI & ML algorithms. It will improve client satisfaction and your app’s profitability.

6. Competitive Advantage:

Although the competition is huge in the fintech industry, there are still ways to stand out apart from your competitors. A user-friendly app will help you with this. You should offer distinctive features with a seamless experience. Furthermore, tools like budgeting tools, financial literary resources, and individualized financial advice make your app lucrative.

7. Improved Privacy and Security:

In the fintech world, privacy and security play the most important role. Cash advance apps focus on user data protection through strong encryption and safe payment procedures. There must be a strong focus on privacy standards. Following the standards will ensure that there is no sharing of personal data to any 3rd party without the permission of the owner.

How does a Cash Advance App like FloatMe work?

You must be wondering what would be the flow or working of the FloatMe app. The mobile app works like this:

1. Users have to download the app and create an account on it.

2. They link their bank account details and get the verification done on the app.

3. After the verification is done, users can ask for an advance for up to any amount like $100 per day.

4. Users who withdraw loans during a particular period must pay a $1 subscription charge every month.

5. Those who have taken money from the FloatMe app can either choose the Auto-debit option in which the money will automatically be allocated to loan compensation after the deposit, or they can choose the manual payback option.

Major Features to Include in a Cash Advance App like FloatMe:

Here are the advanced features that will help your cash advance app to stand out from the competitors:

a. User Registration:

The users should be smoothly onboarded to the app with user registration and account verification. It will help you deliver a personalized experience and security to the users. The users should also be allowed to register on the app through social media channels which makes it easier. Integrate strong identity verification tools like two-factor authentication and KYC (Know Your Customer) processes for the protection of user data and eliminating fraud.

b. Bank Account Linking:

For cash advance app development like FloatMe, users should be able to securely link their bank accounts. There must be integration with trustworthy financial APIs that allow bank account linking. For the protection of sensitive financial information, this capability will help in creating a secure connection with the bank of the users. It will validate account information, and implement bank-level security measures.

c. Easy Loan Approval:

The main feature of the cash advance application is disbursing loans to the users instantly. There must be an automated system for instant loan approval. It will evaluate the financial information of the users such as income, spending, and credit history. It ascertains whether they are eligible for cash advances or not. To streamline this procedure, complex algorithms of Machine learning and Artificial Intelligence are used. It makes it quicker and more precise.

d. Transparent Fee Structure:

The cash advance apps face a common roadblock which is fear of hidden charges. The new users always hesitate to use a cash advance app due to this fear. If you are developing a cash advance app like FloatMe, it is necessary to build trust among the users.

You have to provide all the details of the fee structure, or charges that the users have to pay during the time of loan repayment. There shouldn’t be any hidden fee. If you promote transparency within your app, the users will trust and it will result in a higher conversion rate.

e. Cash Advance Algorithm:

In the cash advance app development, an algorithm will play a major role by deciding how much money customers can borrow based on their financial profiles. You have to create an algorithm that can determine the limit of user borrowing by examining a plethora of variables including income, spending habits, current loans, and credit history. Ascertain that the algorithm compiles with all relevant lending laws and is accurate, fair, and reliable.

f. Notifications and Alerts:

A solid notification and alert system will help keep consumers informed about the status of their cash advances and repayment dates. It will provide users with information on cash advances, repayment reminders, and any alterations of account activity in real-time. As per the preferences set by users, the app will send push notifications, emails, or SMS messages.

g. Repayment Options and Reminders:

The app should provide simple, adaptable payback alternatives to the users to motivate them for responsible borrowing. The users can repay the loans either in full payments or installments as per their choice or financial condition. They can also use automatic reminders to know about upcoming payment deadlines so they remember to make payments. This proactive tool reduces the possibility of late payments while assisting people to properly manage their funds.

h. Secure Authentication:

Security is paramount in the fintech industry. You must implement reliable authentication procedures to safeguard the users’ financial and personal data. Features like biometric authentication and stringent password requirements can increase security.

i. Payment Gateways Integration:

In any cash advance app or fintech, quick and smooth payment is the core of the app. You must integrate reputed payment gateways for easy bank account setup and payment options. You should ensure that the app accepts well-known payment options, including credit cards, debit cards, and electronic wallets. You cater to people’s tastes and improve their overall experience by providing a variety of payment choices.

j. Advance Security Measures:

It is important to protect the users’ financial and personal data. To protect user data from unwanted breaches or hacks, you have to implement strong security methods. It includes data encryption, two-factor authentication, and frequent security audits. When the customers are assured that their financial and personal information is secure on the app, they will trust your app more.

k. In-App Customer Support:

To respond to queries of customers and resolve them as soon as possible, there is a need for a comprehensive chat support system. You have to create an in-app message by which customers can directly contact customer service agents. This immediate channel of contact guarantees rapid problem-solving fosters user confidence and raises general pleasure.

How to develop a Cash Advance App like FloatMe?

You have to follow the below steps to build a robust cash advance app like FloatMe:

a. Market Research:

The app development journey begins by identifying your right target audience and understanding the market. You have to analyze your competitors’ offerings, their strategy, the needs of your target audience, which platform they use for money lending, etc.

You can also consider aspects like demographics, financial requirements, and pain areas of your target audience.

b. Hire a Mobile app development company:

You have to hire mobile app developers who can build a top-notch cash advance app like FloatMe. The mobile app development company will provide you with a team who will manage all the aspects of your Cash Advance app development.

After outsourcing your project to a mobile app development company, you can give your time to focus on the business prospects.

c. Design of User Interface and User Experience:

An app must be attractive in UI & UX to captivate the audience and improve conversions. The designers should ensure that the design should attract maximum traffic. It must be smooth and have no friction in the user’s journey.

d. Development:

The front-end development will put life into the design by ensuring each element of the design works as it should. They will give strong emphasis on the responsiveness of the design. The backend developers, on the other side, will focus on backend development, payment integration, data analytics, cloud infrastructure, and other important aspects. They have to build all the features and functionalities of the app.

e. Testing:

After the development, the QA experts will play their role. They will check the app for any persisting issues or bugs. They have to ensure that the application runs smoothly and provides a bug-free experience. The testers will check the app for usability, performance, and security, among other features.

Wrapping Up:

In this article, we have gone through various aspects of FloatMe like Cash Advance app development. We have vast experience and strong skills in developing fintech apps like FloatMe. Our experienced developers can help you build even the most complex functionalities with ease. Let us know your requirements.