Brigit is one of the most popular apps that help users with seamless access to short-term loans and financial assistance. Its leading finance management app lets you lend money, manage finances, and much more. In this blog, we will discuss finance management app development, building an app like Brigit.

Do you need the money in advance? Login to the Brigit app. Just a few taps and you will get cash in your account. You don’t need to go through the long process of traditional banking or loan systems. That’s why finance management apps like Brigit are highly needed. In this article, we will go through all the major aspects of finance management app development like Brigit. Let’s begin with the basics.

What is the Brigit App?

Brigit is a well-known finance app with over 3 million downloads and boasts an impressive rating of 4.8 out of 5 stars.

Brigit app helps users to manage their finances, avoiding any overdraft fees. It identifies the buying patterns of the users and bank account balances to predict if they are about to overdraw from their accounts. If the app identifies any potential overdraft, it will immediately alert the user through a notification and offer to transfer funds to their account to avoid the fee.

Users can request a cash advance of up to $250, which is repaid with a small fee on their next payday. There is a monthly subscription fee that the users have to pay to leverage its services. It ranges between $0 to $9.99 based on the level of service.

Brigit aims to help its users improve their financial health by providing them with tools to manage their money more effectively and avoid costly fees.

What is the need for apps like Brigit in the market?

For anyone who has limited or low income, has a lot of debt, or has a burden of multiple financial responsibilities, it wouldn’t be surprising that the person will have an account balance near zero. It becomes practically difficult to break that paycheck-to-paycheck cycle.

The person either has to pay a late fee for the bills or has a risk of being charged an NSF (Non-sufficient funds) fee by the bank. This ultimately results in visiting a check-cashing service to ensure that you have money to pay your rent and other important payments on time. In the worst-case scenario, you have to take debts from credit cards, payday, or other type of loans.

If we consider the market statistics, nearly 100 million Americans i.e. equivalent to one-third of the country’s population are dependent on their next payday to make payments for utility bills, rent, loans, and credit card payments.

From a financial perspective, this statistic is disheartening. To make it worse, many payday loan lenders take unfair advantage of this condition and provide unfair loans to debtors in an attempt to keep them in a vicious cycle of debt. This complete cycle is a payday loan trap.

It can financially devastate a person and leave them in a hole that will take a long time to dig out of. Debt might be critical for those living paycheck to paycheck.

People are looking for a better method to bridge the financial gap between when you need money and when you get paid. That’s where apps like Brigit come into action. Apps like Brigit are a better and less expensive choice for all sorts of workers, even those with modest earnings.

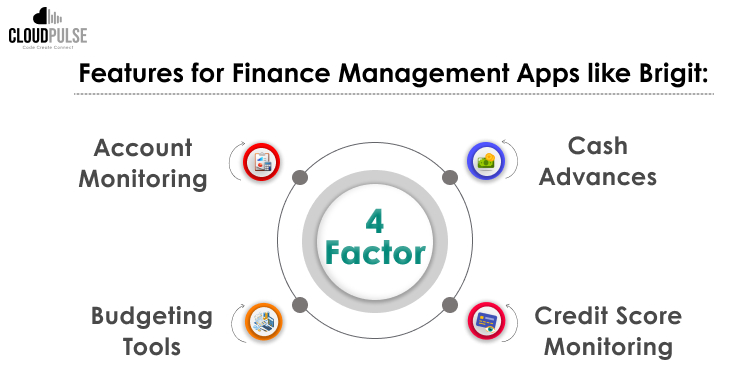

Must-Have Features for Finance Management Apps like Brigit:

There are several features that a finance management app like Brigit should offer to help people manage their finances and avoid any overdraft fees. Here are the major important features:

1. Account Monitoring

Brigit access your bank account and utilize predictive technology to monitor your account balance and transaction history. It helps users avoid overdraft fees and effectively manage their finances.

The app will check if you are on the verge of overdrawing your account through spending patterns and upcoming bills. It will immediately send you notifications and alerts. Users can customize these alerts as per their preferences and set thresholds for when they want to receive notifications.

It also checks your transaction history to identify recurring expenses and instances with the potential to save money. E.g. there can be certain subscriptions or memberships that you may have forgotten and can save money by no longer continuing them.

2. Cash Advances

If you require a little more money till your next pay, you can get it through Brigit. Brigit provides an advance of up to $250. The cash advance is repaid automatically from your next paycheck, along with a small fee.

The cash advance feature is designed to help users avoid costly overdraft fees or other financial emergencies. It employs sophisticated algorithms to rightly determine the ability of the users for repayment based on their income, expenses, and other factors.

3. Budgeting Tools

The budgeting tools help in tracking the expenses and identifying the spot to cut unnecessary expenses. With these tools, users can put restrictions on spending for various categories and receive reminders when they are approaching their limit.

The users will get meaningful insights into their spending habits and can track their expenses over time. They can personalize their budget categories and set their budget limits. Users could also find areas in which they are overspending and propose ways to cut back, like cancelling subscriptions or reducing dine-out expenses.

4. Credit Score Monitoring

The users can track any changes in their credit score over time through the Brigit app. It will give way to the credit score and report, which gets updated regularly. It will give notifications to the users if there are any changes in the credit score or report such as new credit inquiry or late payment.

Furthermore, you will get specific tips for boosting your credit score, like reducing credit card balances or paying bills on time.

Revenue Models for Finance Management Apps like Brigit

Generally, finance management apps like Brigit make money through a monthly subscription fee. Mostly, they don’t charge any hidden fee or interest on the loans, but the users are required to subscribe for their premium features like instant cash advances, credit building tools, and other advanced features.

The range of subscription fees is currently from $8.99 to $14.99. With this model, the users don’t need to rely on the borrower being stuck in debt, which is a departure from traditional payday loan services.

There are two different editions of the Brigit app: Free, and Paid Editions.

1. Free Edition

In this edition, the users don’t have to pay any fee to use the app but they have limited access to the features. They can get instant cash delivery of an advance up to $250 with no credit check, interest, or late fees. It will take 1-3 days to get advanced credited into the account. However, the users don’t get access to features like credit builder, credit monitoring, identity theft protection, Earn & Save, and Finance Helper.

2. Paid Editions

There are two paid editions of the Brigit app: Plus and Premium. The Plus edition costs $8.99 per month while the Premium edition costs $14.99 per month. Both these editions have all the premium features access, except in the Plus edition the users don’t get the Identity Theft Protection feature.

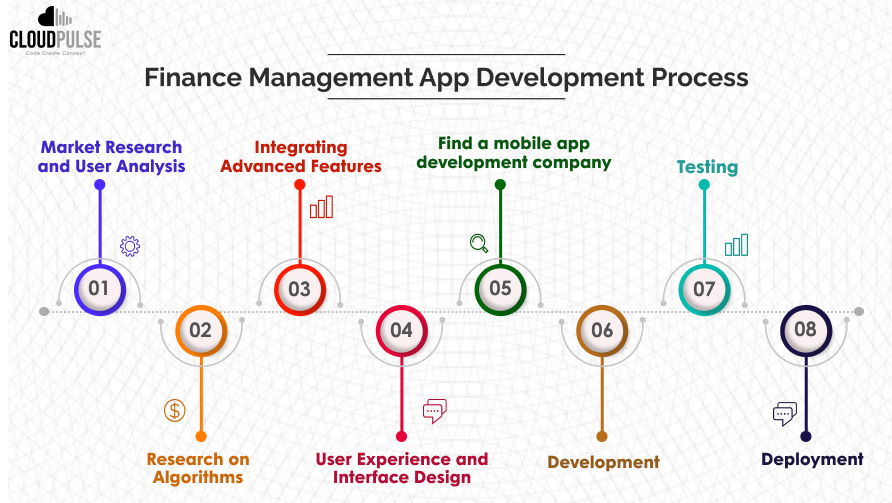

How to Develop a Finance Management App like Brigit?

Developing a finance management app like Brigit requires meticulous planning and development. These are strategic steps to follow to ensure success in the competitive fintech market.

1. Market Research and User Analysis

The process begins with a deep and thorough research of the market. By conducting research, you will get a better understanding of the requirements of your users. It will help you determine the right set of requirements including the features that you must integrate in your app. Proper market research and user analysis are the core fundamentals of any finance management app development process.

2. Research on Algorithms

Finance management app development requires sophisticated algorithms to help users with their spending patterns and maintain finances. You have to research and build algorithms that can analyze user income, spending habits, and financial patterns to determine concise cash advance limits. It helps in ensuring that the users receive the right amount of advance based on their financial behaviour, enhancing user trust and reliability.

3. Integrating Advanced Features

To sustain itself in a competitive fintech market, advanced features are required to differentiate the app from competitors. The major features are:

Cash Advance Algorithms: These algorithms will help in determining cash advance limits accurately.

Auto Advance Feature: An automated system helps in detecting overdraft risks and triggers auto advances, providing users with financial security.

Budgeting and Insights Tools: Analytical tools are required to analyze spending patterns and provide personalized financial insights. Thus, the users can manage their finances in a better way.

Credit Builder Integration: Creating a system that allows people to save for goals and then borrow against those savings to boost their credit scores.

4. User Experience and Interface Design

It is essential to design a captivating and intuitive UI and UX for user engagement and satisfaction. The UX should be focused on ease and accessibility so that users can navigate through the app effortlessly. The personalization features based on individual financial behaviours and goals will further improve the user experience.

5. Find a Mobile App Development Company

You have to hire mobile app developers who can understand and meet your requirements. The mobile app development company will have the required infrastructure, resources, tech, and experience that can help you develop a top-notch mobile app.

Furthermore, by outsourcing your requirements to a mobile app development company, you would be able to focus more on the business part instead of the technical aspects of the app.

6. Development

The mobile app developers will begin the development of the app. The frontend developers would be responsible for ensuring that all the elements of the screen work seamlessly on screens of all sizes. The backend developers have to build the features functionalities and core aspects of the app.

7. Testing

The QA engineers have to test the app to find if there are any existing issues or bugs in the app. They have to ensure the app’s functionality, security, and usability. Our QA engineers conduct extensive testing, including functional, security, and usability testing.

8. Deployment

Once the QA team gives the sign-off, the app is ready to deploy on the cloud infrastructure. The development team will deploy the app on the cloud and further launch it on the popular app stores.

Tech Stack for the Finance Management App Development:

The tech stack of the mobile app plays a pivotal role in defining its success. Here is the tech stack for the finance management app development:

| Purpose | Technology |

| Mobile App | React Native, Flutter |

| Programming Language | Java, Python |

| Databases | MySQL, PostgreSQL |

| Cloud Platforms | AWS, Microsoft Azure |

| Data Analytics | Google Analytics |

| Other Algorithms | ML Models |

How much does it cost to develop an app like Brigit?

There are a lot of factors that will decide the cost of development of a finance management app like Brigit. Some of the prominent factors are the complexity of the app, features and functionalities, location of the development team, experience of the team, etc.

Among all these factors, the location of the development team plays a pivotal role in determining the cost. If you hire mobile app developers from North America, Eastern Europe, or Australia, they will charge you $80-$120 per hour. However, you can get the same quality of development at $25-$40 per hour in Indian mobile app development companies.

The development quality is the same, however, there is a massive difference in the overall costs.

Wrapping Up

Creating a finance management app like Brigit might be a valuable option for businesses. For consumers facing short-term financial difficulties, these applications provide a safe alternative to pricey payday loans. These apps can attract a large number of users and generate revenue by offering small, rapid cash advances, budgeting tools, and responsible repayment alternatives. Let us know your requirements.